9 September 2020

Today, consumers and investors are making more informed decisions about the types of companies they engage and invest in, and sustainability is often one of the considerations. As companies face increasing pressure, clean energy procurement has emerged as one way to decarbonize their operations. More and more companies have since joined the RE100, a global group of large and ambitious companies committed to 100% renewable power. The number of RE100 members more than quadrupled over 2015 to 2019, growing from 50 to over 200 members.

Corporate PPAs can Help Provide Clear Additionality without Requiring Own Investments

As companies evaluate their options, corporate power purchase agreements (PPAs) have been gaining traction. Corporate PPAs are power contracts (typically 10-20 years) between a corporate buyer and an off-site renewable generator. This provides a way to directly source renewable power from a generator, while also providing more flexibility than directly investing into renewable power projects and private wire[1] arrangements. Companies including Apple, Unilever and Google have all signed up for corporate PPAs.

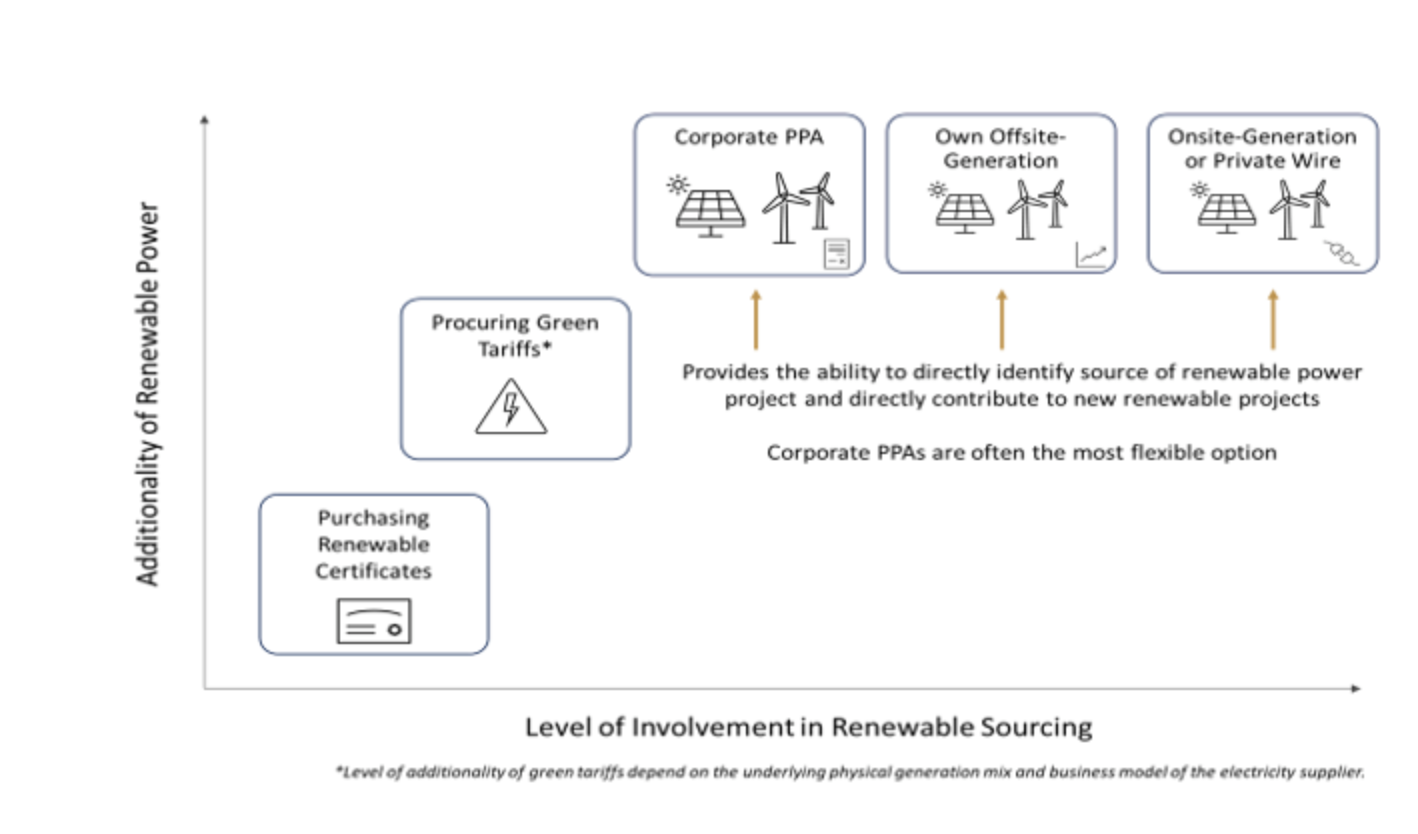

Figure 1: Methods of Sourcing Renewable Power

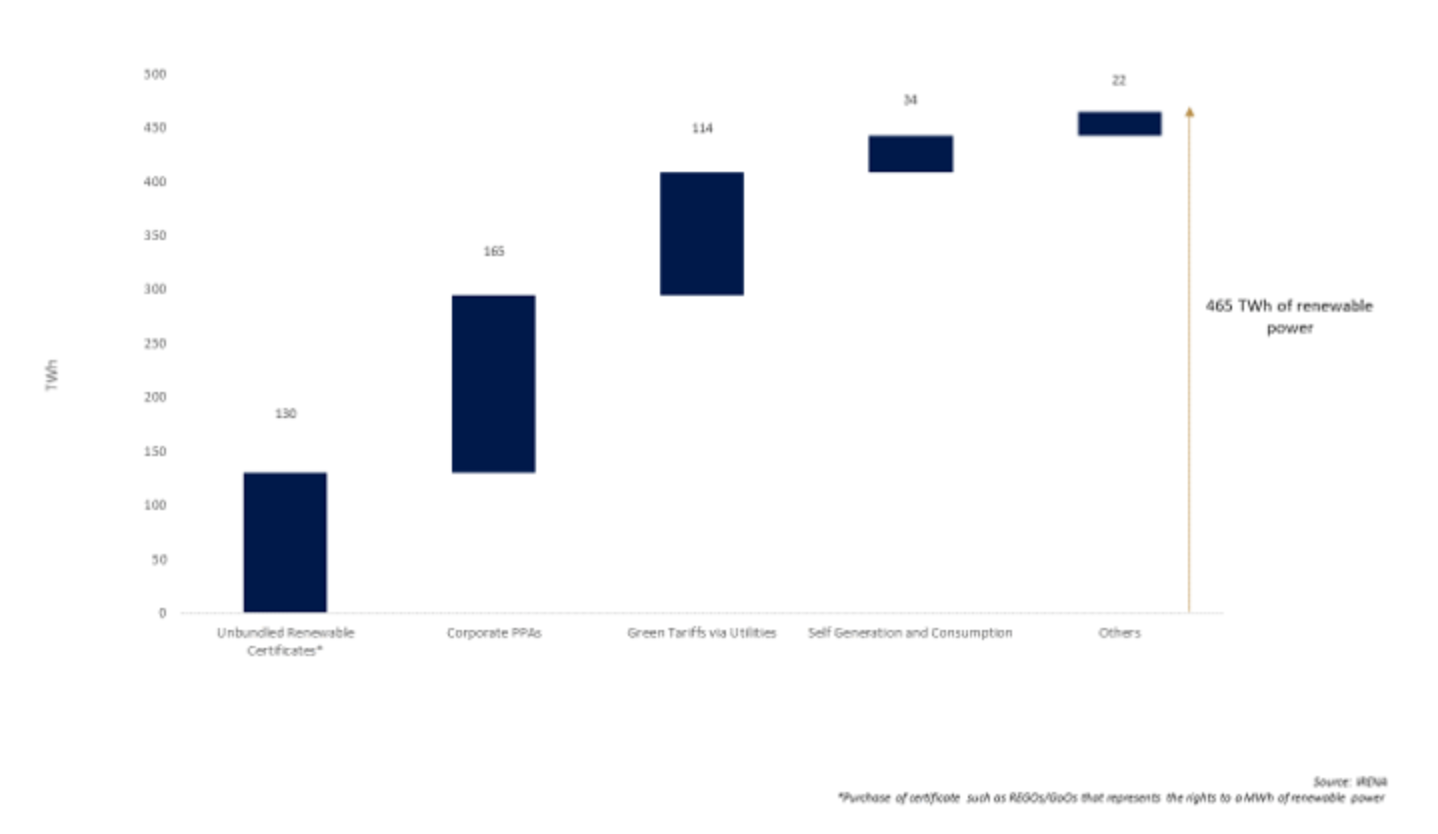

WindEurope estimates that the annual capacity of new corporate PPAs in Europe doubled over 2016 to 2019, growing from 1.1 GW to 2.5 GW. Globally, the International Renewable Energy Agency (IRENA) estimates that corporate PPAs contributed to around a quarter of global renewable electricity sourced in 2017.

Figure 2: Global Corporate Sourcing of Renewable Power (2017)

Corporate PPAs help companies by:

1. Displaying commitment via additionality – Additionality is easier to demonstrate compared to green tariffs/renewable certificates. With corporate PPAs, companies can engage directly with a specific project.

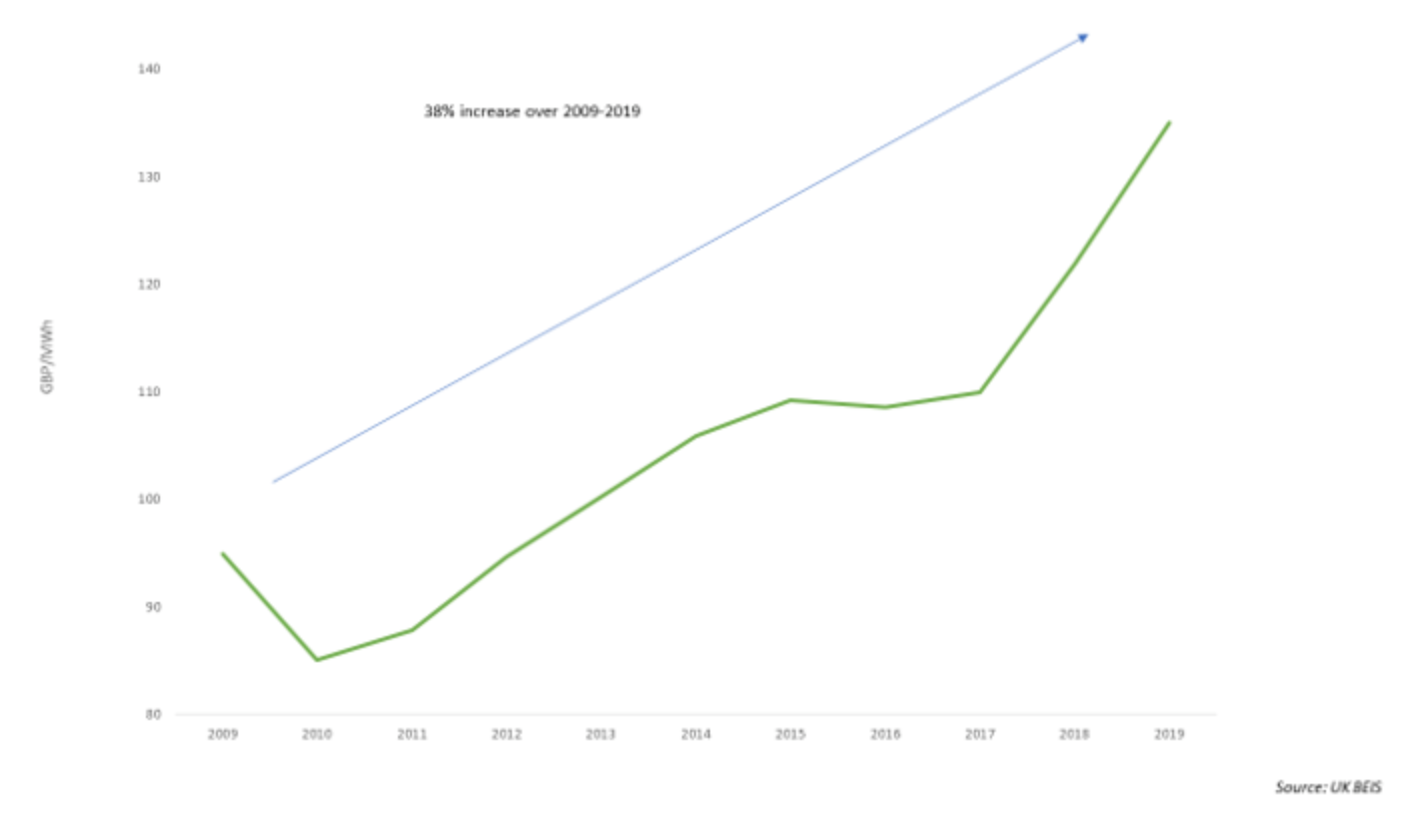

2. Hedging long-term electricity prices – By locking in fixed prices or floating prices with a cap/floor, the company can be protected against future upward movements in the electricity prices. The average electricity tariff for non-domestic consumers has steadily increased over the past decade, and corporate PPAs can help protect against future price movements (Figure 3).

3. Maintaining focus on core business – Renewable energy development and management can be time consuming and complicated. Corporate PPAs allow companies to outsource this to function and focus on their primary business.

Figure 3: Average Electricity Tariff for Non-Domestic Consumers

Renewable power generators also benefit from corporate PPAs. Corporate PPAs help generators by:

1. Increasing project bankability – Securing long-term revenue will lead to more favourable financing terms with banks and financial institutions.

2. Expanding business opportunities – Adds a new route to market for renewable power vs. the typical route of selling to utilities. More opportunities are unlocked geographically, and distributed pockets of demand can also be powered depending on the structure of the corporate PPA.

3. Freeing up capital – Corporate PPAs can help a firm refinance an existing project at more favourable rates, and free up capital for new renewable projects.

There are many ways to structure corporate PPA contracts. Each contract is going to be tailored to involved party’s risk tolerance and energy portfolios. However, there are two main ways of thinking of Corporate PPAs – Physical PPAs and Financial PPAs.

Broadly speaking, Physical PPA (also known as sleeve PPA) are contracts for where electricity is physically sent from the generation to the corporate buyer via an electricity supplier (or directly from the grid in certain jurisdictions).

In a Financial PPA (also known as virtual PPA), the generator sells the power to the wholesale market, and the corporate buyer buys electricity from its electricity supplier. However, the corporate buyer and generator sign a contract-for-difference (CfD), where the corporate buyer would compensate the generator if wholesale prices fall below the agreed upon price. Vice versa, the generator compensates the corporate buyer if wholesale prices increase above the agreed upon price. In this way, electricity does not need to directly flow from the generator to the corporate buyer.

For more details on physical and financial PPAs, please look for our upcoming article on the topic.

Routes to Signing a Corporate PPA

There are several ways a company could go about signing a corporate PPA. Common methods include:

1. Directly negotiating with a renewable generator and/or utility which has generation assets – The traditional way of obtaining a corporate PPA.

2. Utilizing PPA platforms – This has become more popular in the recent years, particularly as a way for smaller businesses to enter the market. These platforms facilitate PPA deals by helping parties issue tenders, screen/benchmark projects, and identify suitable counter parties. Some also act as demand aggregators and can help small businesses back larger projects that they typically would not be able to.

Longevity Partners is a multi-disciplinary energy and sustainability consultancy which can support you in this field. We support businesses in their energy transition and have over 10 years of experience in renewable power feasibility studies and installations. We can help you develop your net zero strategy and source, negotiate, and evaluate corporate PPAs options with renewable power generators. For more information on our energy practice, please contact Anthony Maguire at generators. For more information on our energy practice, please contact Anthony Maguire at anthonym@longevity.co.uk.

[1] Arrangement in which the renewable power generation is not on-site but is connected directly to the corporate consumption via a privately owned transmission line.