12 July 2023

“You can’t manage what you don’t measure.” – Peter Drucker

As climate regulations and investor ESG requirements become ever more ambitious, real estate companies often find themselves in a bind. On the one hand, businesses have a real desire to go above and beyond investor and legislative requirements and show leadership in the fight against climate change, inequality, and social discrimination. On the other, real estate companies with large portfolios can have a difficult time knowing where to begin. While some sectors have achieved rapid emissions declines over the past decade, real estate remains amongst the hardest to abate sectors. Complex physical portfolios and ownership structures mean that, for the real estate sector, the transition to a sustainable footing is a daunting task.

Many Begin Their ESG Journey With ESG Reporting and Data Management

Many in the real estate sector have chosen to adopt reporting frameworks and data management systems as a starting point. Doing so is intended to make it easier for companies to demonstrate ESG leadership – thereby attracting sustainability-conscious capital and demonstrating compliance with sustainability legislation. It has therefore been commonly assumed that, over time, ESG data management and reporting will create a virtuous cycle whereby companies rapidly improve their sustainability performance as they compete for the first position in the race for ESG investment.

In 2006, the British mathematician Clive Humby stated that “data is the new oil”. Companies are witnessing an explosion in the quantity of data at their fingertips, opening a world of opportunities for sustainability disclosure and benchmarking to support ESG investment. Accordingly, the ESG data management sector has experienced considerable growth and is forecasted to grow at around 12% per year over the next five years[1]. Many asset owners are subscribing to platforms such as Deepki in Europe and Measurabl in the United States, which consolidate existing networks of asset-level metering infrastructures into real-time portfolio performance dashboards. These, in turn, offer integrations to reporting frameworks such as Global Real Estate Sustainability Benchmark (GRESB) and Carbon Disclosure Project (CDP) to enable asset managers to cut out the admin and focus on managing their ESG transition.

The breadth and depth of ESG reporting has also grown considerably. Today, one-third of real estate investors consider GRESB reporting to be mandatory[2], while last year CDP disclosure was requested by investors with more than $136trn in assets under management[3]. Additionally, new legislation such as the Corporate Sustainability Reporting Directive (CSRD) and the Taskforce of Climate-related Financial Disclosure (TCFD) is increasing pressure on companies to disclose ESG performance publicly, rather than to investors only. Real estate firms are now, on a large scale, systematically collecting and disclosing information regarding emissions, climate-related risks and opportunities, and environmental policies.

Strategy as the Missing Link to Improve ESG Performance

While many companies now have the tools to measure impact, managing that impact can remain problematic. Many companies that have produced policy documents for reporting purposes may now possess public commitments without a real plan to deliver on them. Similarly, companies that have embarked on ambitious data collection exercises may now be over faced, with no obvious way to interpret ever-growing data lakes. As a result, while some companies have been able to report major ESG progress in recent years, others find themselves exposed, with lagging ESG performance, ambitious policy commitments, and no way to bridge the gap.

Longevity Partners has worked with over 50 real estate clients since commencing ESG strategy advisory in 2020. For many of our clients, engaging in a robust ESG strategy development process has helped to map their data reserves and reporting history onto a concrete and achievable set of ESG targets and KPIs.

Know Where You Are Going Before You Start Driving

Central to strategy development is the concept of materiality. While each company may have millions of data points and extensive reporting histories at their fingertips, this is only useful for setting and achieving targets if it can be used to identify the most relevant aspects of ESG performance to their business.

Materiality assessment initially seeks to identify a set of more relevant ‘low-hanging fruit’ before mapping a course to improving the less relevant, potentially more challenging aspects of a company’s sustainability goals. An integrated approach to peer-review, stakeholder engagement and legislation review can enable companies to gain an awareness of where they sit in key ESG dimensions compared to chosen peers, in addition to a deep understanding of what matters to their stakeholders and a clarity on what might be coming in regard to legislative and investor requirements for their business. Through marrying materiality with realistic targets and KPIs, ESG strategy can provide companies with an edge to set and meet clear goals that matter to investors, societies, and the planet.

Check to Make Sure You Are on the Right Track

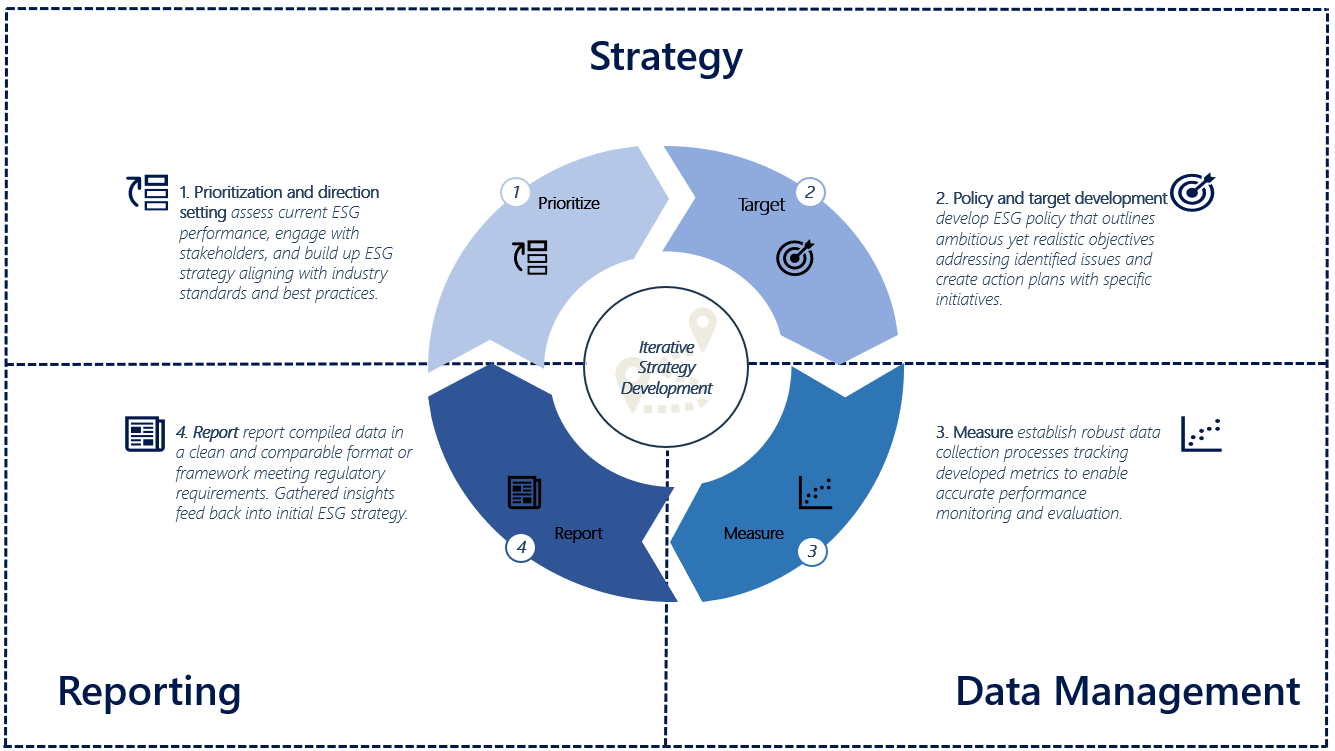

While strategy development can be key to setting businesses on the track to ESG leadership, it is not a one-off. Just as data management and reporting cycles are increasingly being integrated to companies’ annual business plans, iterative strategy refinement is critical to success. Live data can be used to track progress against key sustainability KPIs and evaluate the efficacy of a strategy; meanwhile, continued engagement with reporting frameworks can serve to highlight changing sustainability trends and identify areas for further strategy development. This is particularly relevant when considering the increasing reporting emphasis on ESG topics like biodiversity, climate risks and social impact, which has been gaining increasing attention from regulators, investors, and civil society.

Competitive Advantage through Strategy

Successful achievement of sustainability goals in the real estate sector requires a cohesive, iterative strategy to unite data management and reporting activities. Only a clear and robust strategy can empower companies to overcome increasing reporting obligations both from investors and governments, and assist companies in efficiently navigating growing mountains of data.

At Longevity Partners, our experience strongly suggests that materiality assessment, legislation review, realistic targets and KPIs, along with continuous refinement are critical to transforming data management and reporting activities into a long-lasting and secure competitive advantage in the race for ESG-conscious capital. In the long run, it will be the companies that utilize these steps to develop strategies and unite data management and reporting activities that benefit most from the net-zero transition.

ABOUT THE AUTHORS

James Fenna is a Senior Consultant in Longevity Partners’ London office; and Ole Seidler is a Senior Analyst and the Strategy Country Lead in the Munich office.

The authors wish to thank Ding Li for her contributions to this article.

Longevity Partners possesses extensive experience in designing effective, bespoke strategy solutions for real estate clients. If your company is interested in knowing more about how Longevity Partners can help you become a true sustainability leader, contact us for a conversation.

[1] https://www.strategyand.pwc.com/de/en/functions/esg-strategy/esg-software-market.html

[2] https://www.gresb.com/nl-en/insights/gresb-2022-investor-member-survey-findings/