9 September 2020

In today’s market, we often hear of many electricity companies marketing green energy tariffs, backed by 100% renewable power. This seems like a straightforward way to reduce our carbon emissions and support renewable energy, particularly as consumers and companies become more conscious of their carbon footprint.

However, thinking about the intermittent nature of renewable energy and the fact that many electricity suppliers are not integrated into upstream power generation, what does 100% renewable backed power actually mean?

Ofgem’s Fuel Mix Disclosure Requirement and Green Tariffs

Since 2005, all electricity suppliers in Great Britain have had to disclose their fuel mix to their consumers if electricity is supplied over a full year period (April 1 to March 31). To validate a company’s renewable generation, the UK Office of Gas and Electricity Markets (Ofgem) uses Renewable Energy Guarantees of Origin Certificates (REGOs). Electricity suppliers may also use Guarantees of Origin, the equivalent of REGOs in EU member nations. Together, this forms the backbone of the green tariffs commonly marketed in the UK.

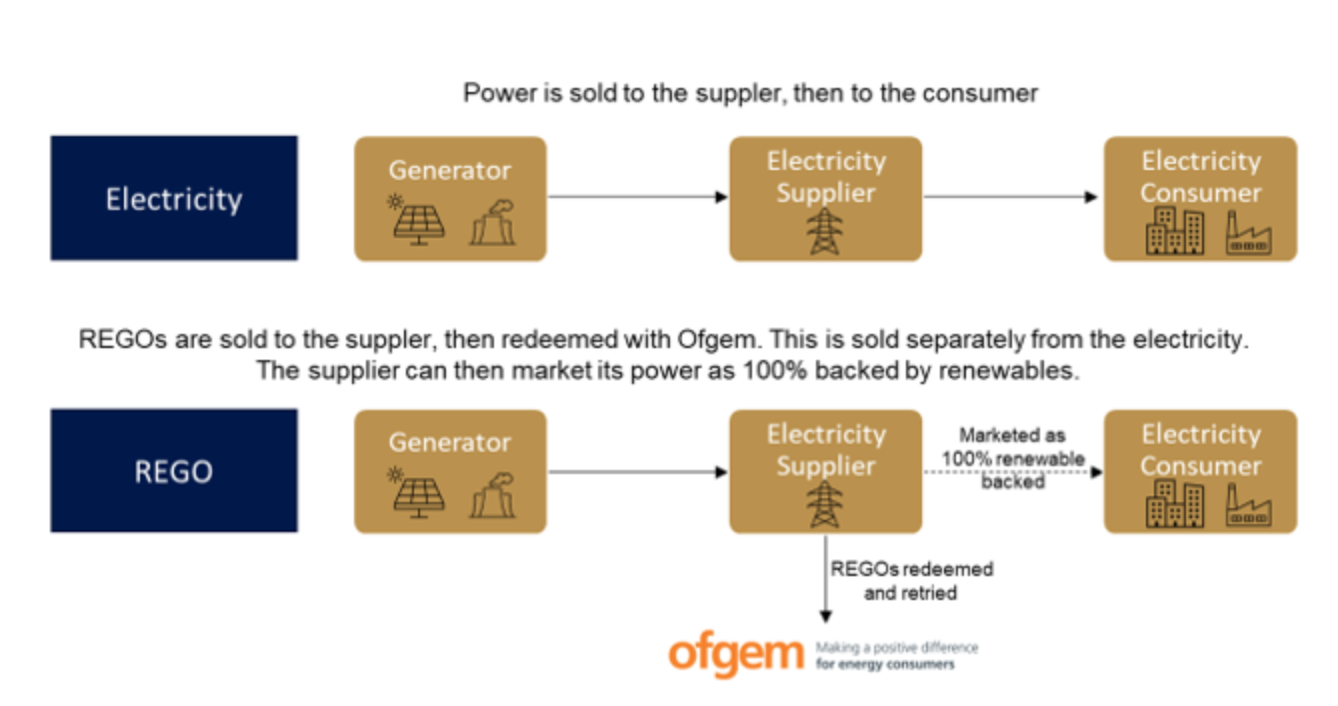

REGOs are Issued to Renewable Power Generation and Sold Separately from the Electricity

Ofgem issues a REGO for every 1 MWh of renewable power produced by a generator. REGOs are traded on their own market, independent of the power unit produced. This means REGO prices are entirely determined by the supply and demand of REGOs.

Figure 1: Electricity Sales vs. REGO Sales

REGOs are primarily traded on the Over-The-Counter (OTC) markets – bilaterally between two counter parties – and hence there is very little price transparency. REGOs can also be obtained from auctioning websites such as Renewable Exchange and E-Power. Electricity suppliers can buy REGOs from power generators and use them to sell 100% backed renewable power and in their fuel mix disclosures.

Many electricity suppliers in the UK offer green tariffs and some have their own renewable power generation plants. Many also procure electricity from the wholesale markets (a mix of fuels, renewable and fossil) and procure additional REGOs to back this wholesale power. Because of the intermittent nature of renewable power, the wholesale market is crucial in balancing supply and demand.

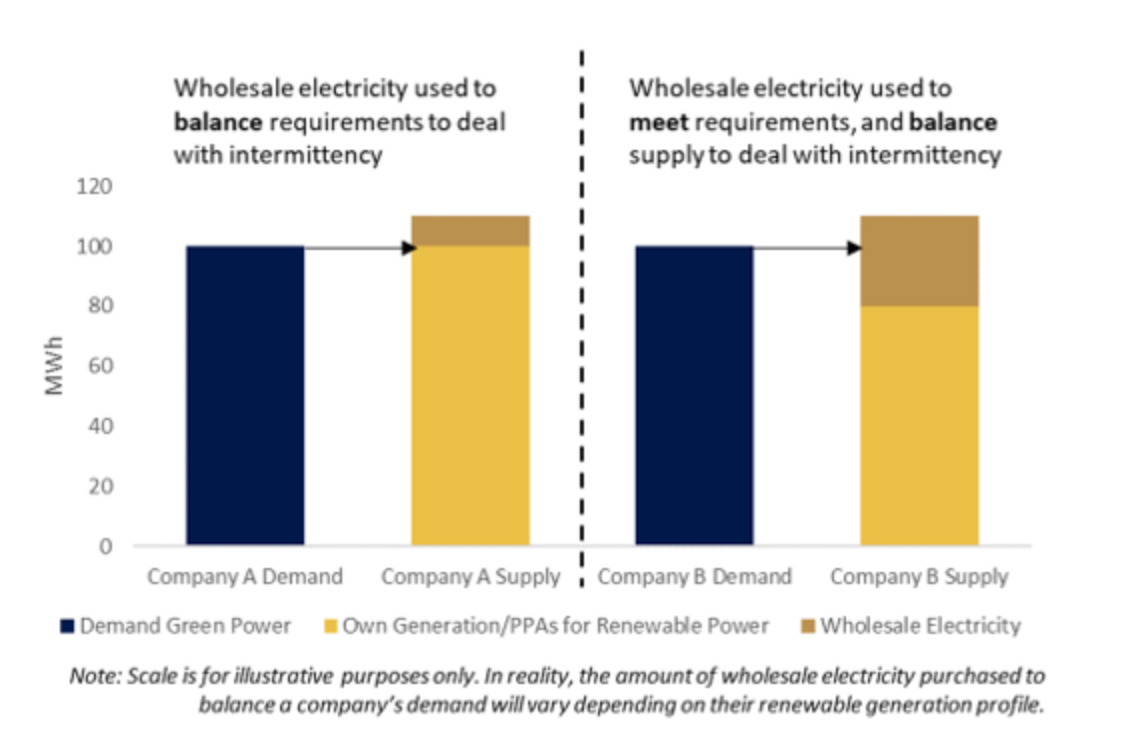

One key differentiating factor between electricity suppliers is the extent of their reliance on the wholesale electricity market. For example, we could have two companies, Company A and B. Both have sold 100 MWh of green electricity but have different electricity supply arrangements. To keep things simple we assume both only have renewable power in their power supply (own generation and direct purchases).

1. Company A generates and directly purchases 100 MWh of renewable power and REGOs. It uses the wholesale market to deal with intermittency and balance its load requirements.

2. Company B generates and directly purchases only 80 MWh of renewable power and REGOs. It relies on the wholesale market both for electricity supply and for balancing purposes. It must buy 20 MWh worth of REGOs to meet its renewable power obligations.

The key difference is the role of the wholesale market and the REGO requirements. Company A does not need to buy additional REGOs since it has sufficient REGOs from its renewable energy sources. It relies on the wholesale market only for balancing purposes. Company B uses the wholesale market for balancing purposes, but also to cover its short power position. It must then buy additional REGOs to cover this 20 MWh dependence.

This wholesale electricity in this example can be substituted with fossil fuel-based generation (own generation or directly purchased).

Figure 2: Role of the Wholesale Electricity Market

Today’s Over Supplied REGO Market and Crash in Prices

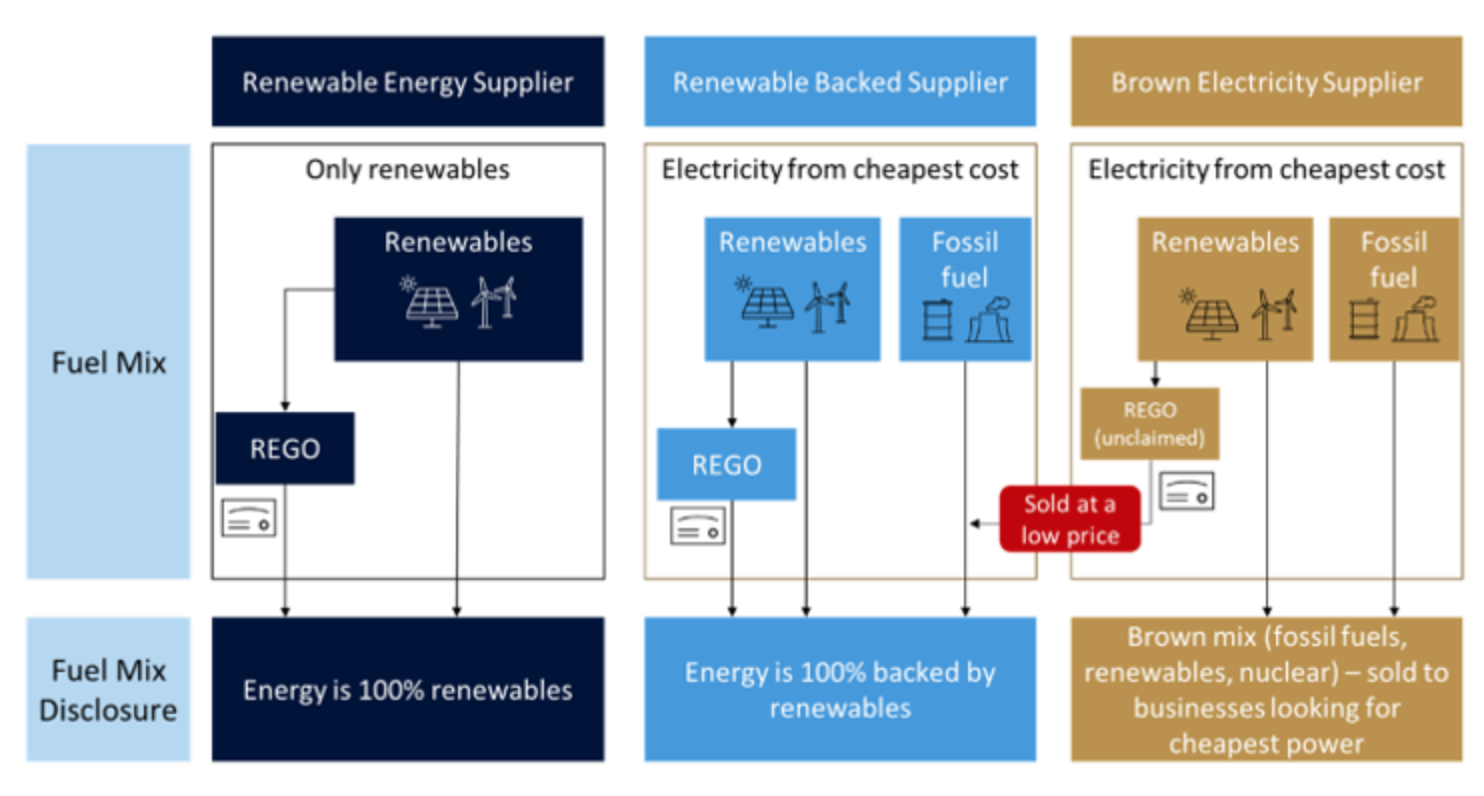

Ofgem estimates that there is currently an oversupply in the REGO market, with supply outstripping demand by around 20% in 2018. This is because not all renewable power is sold with REGOs, for example some large factories may only care about getting the cheapest electricity from a supplier. If the supplier has renewable power in their portfolio, possibly from an earlier incentive scheme from the government, this creates surplus REGOs. This also happens in the retail domestic market, where many consumers are still on the default tariff (which is a mix of fuels in many companies).

Figure 3: The REGO market and its Role in the Fuel Mix Disclosure

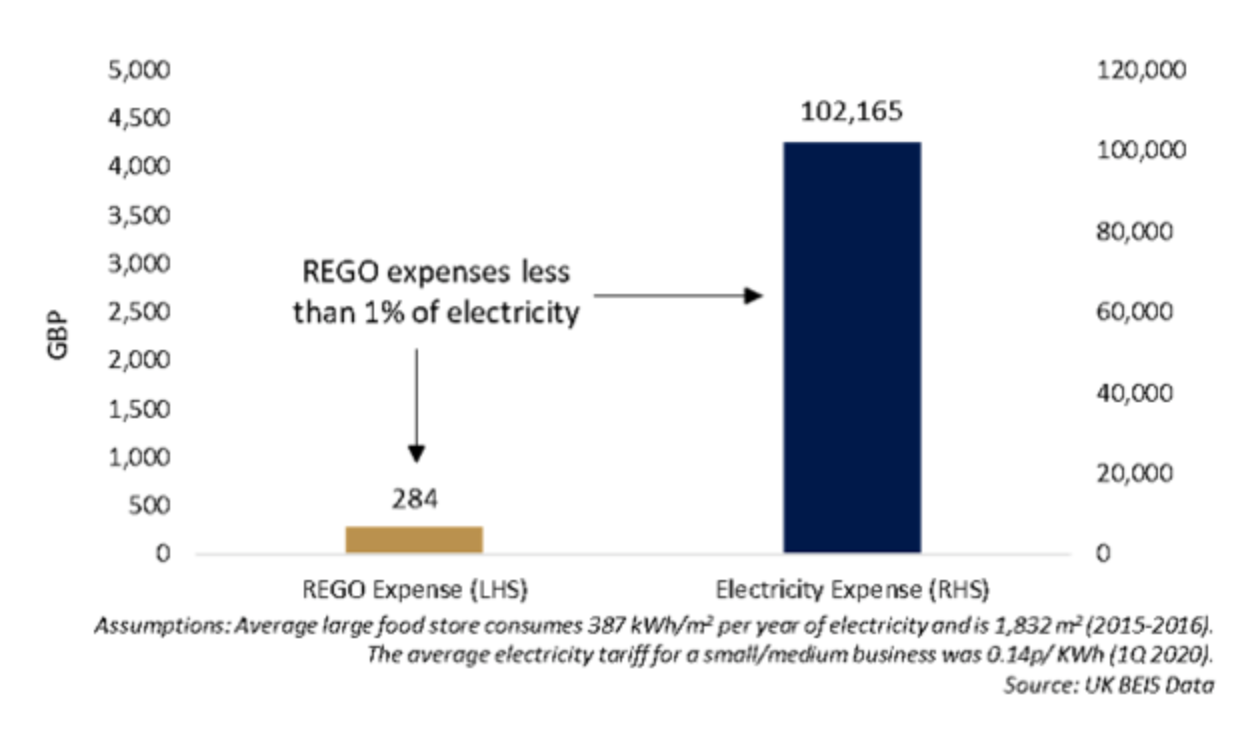

This surplus has led to low REGO prices. The price of a REGO certificate is reportedly around 30-50p/MWh. Comparatively, on average a large food store such as Tesco, Sainsbury’s, or Waitrose paid 144 pounds/MWh[1] for power in Q1 2020.

This means the costs of REGOs to certify a large food store’s electricity consumption is less than 1% of its electricity expense, i.e., it is very cheap to certify that a building uses renewable backed electricity.

Figure 4: Annual Electricity Expense for a Large Food Store

The main problem arising from all this is that prices have fallen to a point where the unique selling point of a 100% renewable powered business is diluted. Some utilities do invest or sign power purchase agreements (PPAs) directly with renewable power suppliers and solar/wind farms – however it is difficult for them to differentiate themselves in this market. It also makes it hard for new renewable projects to gain financial support from the REGO scheme. In essence, REGOs may not be contributing to the additionality of renewable power.

Consideration for Businesses that Want to Support Renewable Power

Short of a regulatory intervention from Ofgem, businesses can:

1. Conduct thorough Due Diligence : Make sure you understand where your supplier sources electricity from – how much are they depending on the whole sale market and how does their renewable power portfolio (both own plants and PPAs) compare against their consumers.

2. Sign Corporate PPAs : Source renewable power directly with solar/wind farms, off-taking both the power and the REGOs. This comes with the added benefit of being able to identify exactly which solar/wind farm you are supporting to your customers/investors.

3. Increase Self-Generation of Renewable Power : Examine your existing assets and determine how you can maximize the use of asset spaces for solar PV and storage systems.

As the demand for REGOs increases, market forces will help to correct this pricing problem. However, as the UK works towards carbon neutrality by 2050, businesses and Ofgem needs to address this sooner rather than later.

Longevity Partners is a multi-disciplinary energy and sustainability consultancy which supports businesses in their energy transition. We have over 10 years of experience in renewable power feasibility studies and installations. We can help you with sourcing, negotiating, and evaluating corporate PPAs with renewable power projects. For more information on our energy practice, please contact Anthony Maguire at anthonym@longevity.co.uk.

[1] Based on the UK BEIS Data for the average energy consumption of a large food store and the electricity tariff for enterprises consuming 500-1,999 MWh/year.