In an effort to promote transparency and showcase alignment with best practices of responsible investment UNPRI signatories should voluntarily report their activities using the PRI reporting framework.

The global voice of responsible investment

In partnership with the UNEP Finance Initiative and the UN Global Compact

STRUCTURE

- Tools: Actionable tools to incorporate ESG issues in investment practice

- Network: International network of asset owners and investment managers

AIMS

- Advancement: Improve signatories’ responsible investment practices

- Discussion: Create a space for collaborative development between peers

- Learning: Develop signatories’ ESG journey with the PRI Digital Forum

Benefit from the PRI signatory network

STATUS

- Be part of a global network of asset owners and investment managers encompassing best in class in ESG and responsible investment.

- Be able to benchmark responsible investment approaches against peers.

INVESTMENT

- Raise interest of investors with PRI as a minimum requirement.

- Improve access to sustainable financing and green debt.

- Use PRI label in marketing material.

GROWTH

- Become a leader in the evolving landscape of ESG investing.

- Develop strategies to advance ESG portfolio integration.

- Access research and training materials enhancing responsible investment offerings.

In an effort to support all UNPRI signatories within the real estate sector, Longevity Partners has developed a reporting tool that models the PRI reporting guidelines, modules, and logic guide in a single document. With our reporting tool, signatories can incorporate their responses from 2021, update their answers, understand what modules and indicators are specific to their disclosure, and prepare for the opening of the web portal.

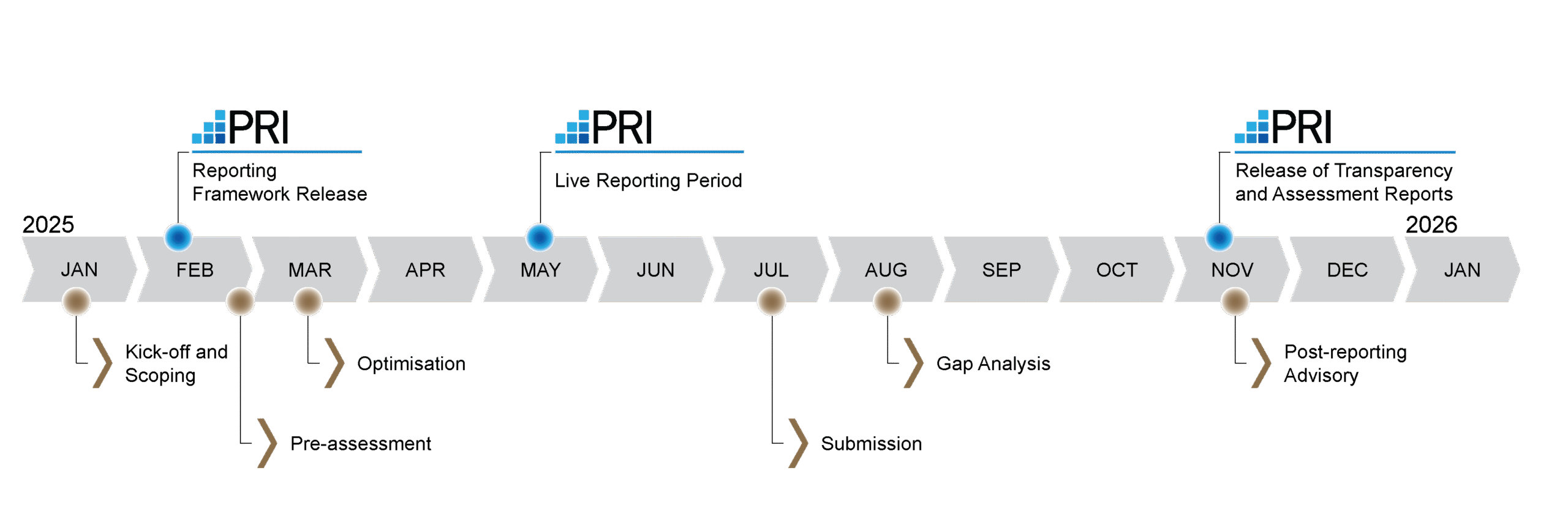

The 2025 UNPRI reporting timeline

How can Longevity Partners help you?

|

PRI Reporting |

PRI Strategy Implementation |

|

Longevity supports our clients’ UNPRI signatory submission through:

|

Longevity provides ad-hoc advisory services regarding responsible investment or UNPRI expertise including:

|

Strategy & Reporting Services:

Get in touch

Tell us about your project

"*" indicates required fields