27 September 2021

To limit global warming to 1.5°C, the world needs to be carbon neutral by 2050. Real estate investors are racing to capture the business opportunities and mitigate risks in the transition towards a zero-carbon economy. To date, 128 asset managers, representing approximately $43 trillion in assets under management (AUM), are committed to the Net Zero Asset Managers initiative and supporting the goal of net-zero greenhouse gas emissions by 2050 or sooner.

The Importance of Setting an Appropriate Target Boundary

To develop a net-zero carbon target and roadmap, the first and arguably the most critical step is defining the target boundary. It is essential to allow fair comparison and track progress towards the target. However, real estate investors face unique challenges in scoping and defining the range of emission sources to be included in the target, for example, the need to address indirect Scope 3 emissions through tenant engagement and sometimes short holding period of the assets.

Different Guidelines, Different Definitions

While various organisations have developed definitions and methodologies around net-zero carbon, to date, there is no universal standard of target scopes and boundaries. Listed below are some of the key pledges and frameworks currently operating in the real estate investment industry:

World Green Building Council (WGBC) Net Zero Carbon Buildings Commitment

The Commitment urges businesses, cities, and governments to operate all new buildings at net zero carbon by 2030. All buildings will be net-zero carbon in operation by 2050. The target boundary includes all assets under the entity’s direct control. In the meantime, WGBC Advancing Net Zero also advocates for integrating embodied carbon in the roadmap towards net zero. By 2030, new buildings, renovation and infrastructure should have 40% less embodied carbon and then achieve net-zero embodied carbon by 2050.

UN-convened Net-Zero Asset Owner Alliance

Led by the former Executive Secretary of the United Nations Framework Convention on Climate Change (UNFCCC), Christiana Figueres, the alliance was founded in 2019 at the UN Climate Action Summit. A group of 43 leading global investors, with $6.6 trillion in AUM, committed to decarbonise their portfolio and achieve net-zero by 2050. The framework also comes with engagement targets, financing transition targets, and policy engagement targets.

Net Zero Asset Managers Initiative

Over 120 asset managers committed to supporting decarbonisation towards net-zero by 2050 or sooner and pledged to invest in assets aligned with the goal. The pledge requires signatories to develop investment products in line with net-zero by 2050 and “facilitate increased investment in climate solutions.”

Urban Land Institute (ULI) Greenprint Net-Zero Goal

The ULI Greenprint goal focuses on addressing carbon emissions under its members’ operational control, aiming to reduce greenhouse gas emissions by half by 2030 and achieve net-zero by 2050. The goal references the World Green Building Council definition of net-zero. It encourages members to prioritise energy-efficient and renewable energy opportunities on their journey towards net zero.

Better Building Partnership (BBP) Climate Commitment

BBP represents members of 26 of the world’s largest real estate owners and managers. The coalition published the Climate Change Commitment to align the net-zero carbon pathways for real estate investors. The pledge aims to “deliver net-zero buildings by 2050 incorporating both direct and indirect investments, operational and embodied carbon and Scope 1, 2 and 3 emissions.”

Science-based Targets Initiatives (SBTi) Net Zero Standard

The Science-based Targets Initiatives (SBTi) is founded by CDP, the UN Global Compact (UNGC), the World Resources Institute (WRI) and WWF. The initiative provides methodologies and pathways for businesses to develop decarbonisation targets in line with what “the latest climate science deems necessary to meet the goals of the Paris Agreement”. SBTi is also developing the first global standard to guide companies in setting science-based net-zero carbon targets, which will formally launch in November 2021. In the Net-Zero Criteria Draft for Public Consultation, SBTi discussed the importance of establishing a target boundary that should cover ‘the most material emission sources in the company’s value chain.’

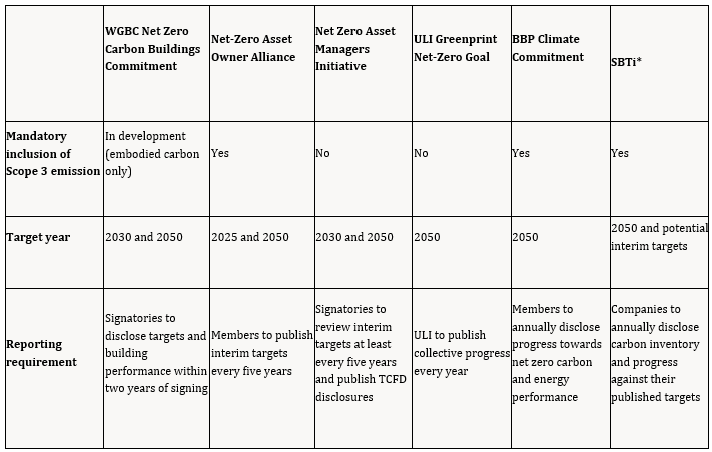

Below is a comparison of the target scoping requirements of various net-zero carbon guidelines:

* Remarks: According to the draft net-zero criteria published in Jan 2021.

Apart from industry commitments, governments have also started to develop voluntary and regulatory frameworks in defining net-zero targets, such as the Australian Climate Active Certification and the Japanese Zero Energy Buildings (ZEB).* Remarks: According to the draft net-zero criteria published in Jan 2021.

However, these regulations are not translatable to other regions. As a result, around the globe, a standardised definition and target-setting framework for net-zero carbon are still lacking in the real estate investment sector.

Real Estate Investors Need a Standardised Net Zero Carbon Certification Scheme

The confusion associated with these competing standards and guidelines has created challenges for businesses when comparing net zero carbon targets in like-for-like terms and has potentially opened doors to greenwashing.

As the ESG landscape currently stands, there is a desperate need for a standardised certification framework to verify companies’ net-zero targets. It is expected that the SBTi Net-Zero Standard would serve as a global certification standard for corporate net zero carbon targets. However, a standard tailored to the real estate sector and especially to investment companies is still awaiting.Longevity Partners develop an ambitious, yet practical net-zero carbon roadmap with our 5-step approach – Measure, Optimise, Generate, Source and Offset.

Reach out to our experts today to find out more.